unlock

your expertise

with my529

An advisor-friendly 529 college savings plan

Your No. 1 job is to help your clients realize their financial goals. One goal many clients have is to save for college.

my529 is a clear, focused, and practical 529 plan that works for your clients — and you.

- Benefits for your clients.

- Benefits for you.

Share class change for underlying fund; savings passed on to account owners

The Vanguard Total International Stock Index Fund moves to a lower-cost share class as of May 2, 2024. my529 is passing on the savings to account owners.

The share class change, with its 3-basis-point reduction, provides a collective annual savings of $101,000 for clients who work with advisors, benefiting more than 37,000 accounts.

The ticker symbol for the fund will shift to VTISX from VTPSX.

-

my529 to Roth IRA transfers with SECURE 2.0

SECURE 2.0 offers an exciting new opportunity—allowing my529 account owners to transfer funds to a Roth IRA. While still new, […]

-

Financial planning for children with special needs

my529 met Neil Mahoney at a recent event where he presented on the topic of financial considerations for families with […]

-

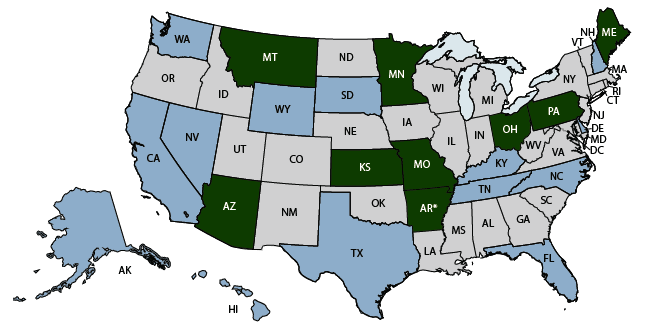

The state of 529 tax advantages

Are incentives available where you live? As tax season approaches, it is important to inform your clients about state income […]